Tax Filing 2026: Your Complete Guide to Filing 2025 Taxes

Tax filing for the 2026 season is the process of reporting your 2025 income and financial details to the IRS. Timely and accurate filing is crucial for maintaining legal compliance, avoiding costly penalties, and securing any tax refund you are owed. This guide will walk you through everything you need to know.

Who Needs to File Taxes in 2026?

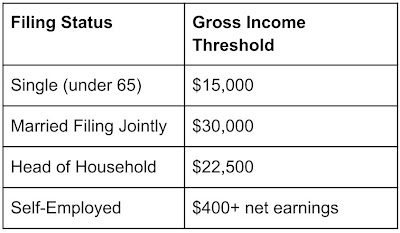

Filing requirements for the 2025 tax year depend on your income, filing status, and age. Generally, you must file a return if your gross income exceeds the standard deduction for your status. However, you should file even if you don't meet these thresholds if you are eligible for refundable tax credits like the Earned Income Tax Credit (EITC).

2026 Tax Filing Deadlines You Must Know

Mark these critical dates on your calendar for the 2026 tax season:

- January 31, 2026: Deadline to receive W-2 and 1099 forms.

- April 15, 2026: Federal tax filing and payment deadline for 2025 returns.

- June 15, 2026: Deadline for U.S. citizens living abroad.

- October 15, 2026: Final deadline if you filed a tax extension (Form 4868).

Important Note: A filing extension is not a payment extension. Any estimated taxes owed are still due by April 15, 2026.

Documents Needed to File Your 2025 Tax Return

Gather these essential documents before starting your tax filing:

- W-2 Forms: From all employers.

- 1099 Forms: For freelance, investment, or retirement income.

- 1095-A Form: For ACA Marketplace health coverage.

- Prior-Year Return: Helpful for reference.

- Receipts: For deductible expenses (charitable, medical, business).

- Bank Account Details: For direct deposit of your refund.

Step-by-Step Tax Filing Process

- Collect all 2025 income and deduction documents.

- Choose your filing method: tax software, a CPA, or IRS Free File.

- Determine your correct filing status (e.g., Single, Married Filing Jointly).

- Report all income, including side gigs and investments.

- Claim all eligible tax deductions and credits.

- File your return by the April 15, 2026, deadline.

- Track your refund using the IRS "Where's My Refund?" tool.

Choosing Your 2025 Tax Filing Status

Your filing status (Single, Head of Household, Married Filing Jointly/Separately, Qualifying Surviving Spouse) directly impacts your standard deduction and tax brackets. Selecting the wrong status is a common error that can affect your tax liability or refund amount.

Top Tax Deductions and Credits for 2025

Lower your tax bill by leveraging these key benefits:

Key Deductions:

- Standard Deduction: Expected to be around $15,000 (Single) and $30,000 (Married Filing Jointly).

- Itemized Deductions: Mortgage interest, SALT deduction (capped at $10,000), student loan interest (up to $2,500).

- Retirement Contributions: Deductions for Traditional IRA and HSA contributions.

Valuable Credits:

- Child Tax Credit: Up to $2,000 per qualifying child.

- Earned Income Tax Credit (EITC): Worth up to $8,046 for eligible filers.

- American Opportunity Tax Credit: Up to $2,500 for education expenses.

- Saver’s Credit: For eligible retirement plan contributions.

Artikel Terkait

Konflik Internal TPUA: Pergeseran Kuasa Hukum, Tuduhan Pengkhianatan, dan Masa Depan Tim Anti Korupsi

Proyek 35.000 Mobil India Dikritik: Beban Fiskal Rp 10.000 T & Potensi Penyimpangan

Viral! Taksi Premium Rp 1,5 Juta untuk 80 Km, Netizen Heboh

OJK Jatuhkan Denda Rp 5,35 Miliar ke Influencer Saham BVN: Modus Pump and Dump Terungkap